Discipline begins with nonnegotiables, even with something simple like making your bed as soon as you get up. Discipline, and nonnegotiables, must happen whether you like it or not.

In the past few years I have come to learn and accept the fact that motivation is unreliable. And on top of that I have also learned that you cannot “wait to be motivated” before taking action, because all of that waiting will likely be a waste of time. Unfortunately we are more easily drawn toward pleasure, leisure, and eating yommy potato ships, and that’s why I think it’s better to change your behavior and build up good habits than to only try psychologically beating your own human nature.

Start Building a Boat

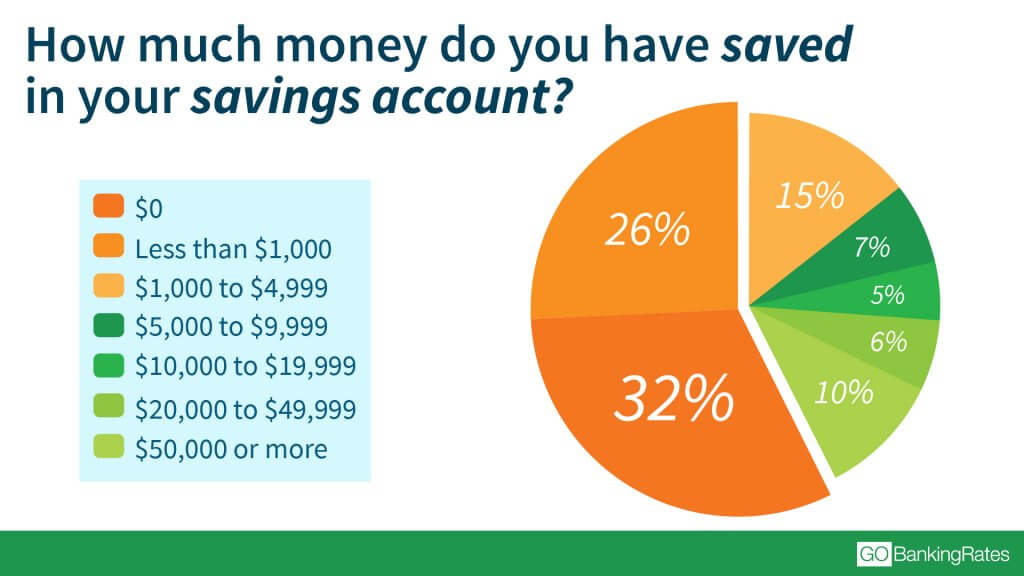

To demonstrate my reasoning and unpack my mindset I will focus on the spooky world of savings. According to recent data by GOBankingRates, in a survey of 5000 adults, 58 percent of respondents claimed they had less than $1000 saved. There are several reasons why people should have some sort of savings, the primary one being to absorb risk so that when the flood comes you have something to float on rather than drowning instantly. By having some sort of savings, people can use that for emergencies (real emergencies, not stupid stuff like pre-ordering Medieval II: Total War HD Remake with day one DLC) instead of having to unnecessarily dump all emergency expenses on credit, and thus risk using credit irresponsibly.

There are handful of articles out there on tips and tricks to helping you build good habits for building up a savings account, such as automatic transfers to your savings account when you receive your paycheck (set-and-forget), and pretending your savings account doesn’t exist (out of sight, out of mind). My problems with some of these are that:

1) they do not help me build self-control

2) I like tracking all my stuff and knowing exactly how much I have to play with, and how much I have in reserve, cuz I play strategy games and you’d only understand if you’re a kewl nurd liek me.

My issue with set and forget, for instance, is that it does not encourage me be an active participant in my victories and accomplishments. I don’t want to win by accidentally using my tools correctly; I want to willfully choose to take the necessary steps to reach my goals. My issue with “out of sight, out of mind” is that I want to maek my kewl spreadsheets and graphs and track my own progress over time. Additionally, I want to be able to look at my savings, and anytime my primitive kitten brain says I should buy a new game or build a new PC or a cute outfit, I want to tell my brain “no,” every time, without fail. I’m a big girl now and I need to stick to my plan and learn to control myself. I think shifting one’s behavior like this is a good way to learn both self-control and self-discipline. As a result, I have been able to consistently pay myself first by budgeting savings first, and then other expenses come afterward. If I can’t afford yummy candies this week, oh well, too bad. I can endure and wait for some other time. Am an adult! Fite me IRL, stoopid brane!!! 3:<

This Counts as a Snow Level

Discipline becomes an even greater virtue when tackling longer term projects, and in these instances you’d definitely benefit from a strong foundation. For example, two methods for tackling debt are the snowball and avalanche methods. The premise of the snowball method is to start small and build up like a snowball: prioritizing most of your monies toward paying off the smallest debts first to give yourself little victories along the way to the final boss. In the avalanche method, you would prioritize most of your monies toward paying off the highest interest rate debts, which will result in you paying less interest over the course of the repayment period. I personally prefer the avalanche method since it’s the mathematically better option, and because I already know I can pull it off given my level of discipline. For someone who may be less interested in min-maxing, or less able to control their spending, or have fluctuating income, they may be more easily able to succeed with the snowball method.

Overall, I believe the process of becoming a more disciplined person is twofold: it is both a matter of finding out your own operating system and how you function (what works and doesn’t work for you), as well as committing to adjusting your behaviors and habits to reflect what you are capable of. At first discipline may not feel good, but it does tend to bear better fruit. And furthermore, discipline is also putting into practice what you say “yes” to and what you say “no” to. You have to limit yourself (your spending), but also allow yourself (to spend) so that you can understand that your choices are ultimately beneficial in a multitude of ways. If you look into the heart of your wallet you’ll know that I’m right. Nyaa~

Never forget that the man who moves a mountain begins by carrying away small stones.

If you found this useful or insightful, consider sharing it. ^w^

You can support me with Brave browser and tipping me BAT. To see all ways you can support me, read my support page~